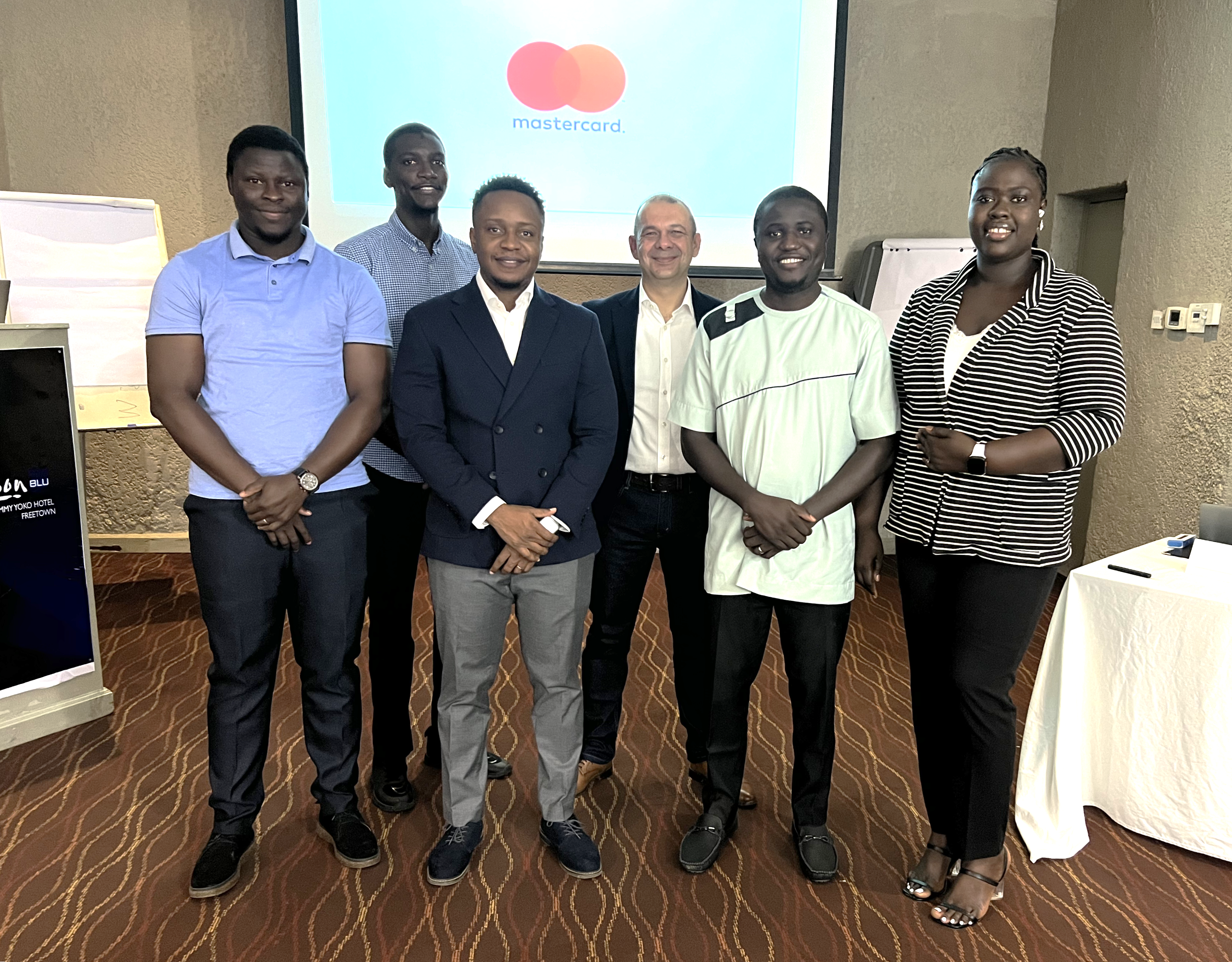

Elizabeth Ndene

August 8, 2024

7 mins read

Mastercard Training: Acquirer Risk Management, Best Practices, and MPGS Optimization

This week, I and my teammates Sheriff, Hassan, and Ousman had the opportunity to dive deep into several critical areas with Mastercard over a comprehensive three-day training program help in Freetown Sierra Leone. The training was centered on

Mastercard Performance Programs for Acquirers: We explored the various performance programs Mastercard offers to acquirers, designed to enhance operational efficiency and optimize transaction processing. The focus was on leveraging these programs to boost performance metrics and drive overall growth.

Acquirer Risk Management and Best Practices: The training provided a thorough examination of risk management strategies specific to acquirers. We discussed best practices for mitigating risks, managing fraud, and ensuring compliance with regulatory requirements. Practical case studies illustrated effective risk management approaches and their impact on maintaining secure transactions.

Payment Facilitator Obligations and Risk Management Best Practices: A significant portion of the training was dedicated to understanding the responsibilities and risk management practices for Payment Facilitators. We reviewed compliance obligations, strategies for managing associated risks, and how to maintain a secure and efficient payment ecosystem.

Mastercard Payment Gateway Service (MPGS) Walkthrough: We received a hands-on walkthrough of the MasterCard Payment Gateway Service (MPGS). This session covered the gateway's features, functionalities, and integration processes, providing valuable insights into how to effectively utilize MPGS for seamless transaction processing.

Overall, the training offered a comprehensive view of Mastercard’s frameworks and tools for enhancing performance, managing risks, and optimizing payment processing. The knowledge gained will be instrumental in our work Gamswitch Company Ltd refining our practices and ensuring robust, secure, and efficient operations.

Mastercard Performance Programs for Acquirers: We explored the various performance programs Mastercard offers to acquirers, designed to enhance operational efficiency and optimize transaction processing. The focus was on leveraging these programs to boost performance metrics and drive overall growth.

Acquirer Risk Management and Best Practices: The training provided a thorough examination of risk management strategies specific to acquirers. We discussed best practices for mitigating risks, managing fraud, and ensuring compliance with regulatory requirements. Practical case studies illustrated effective risk management approaches and their impact on maintaining secure transactions.

Payment Facilitator Obligations and Risk Management Best Practices: A significant portion of the training was dedicated to understanding the responsibilities and risk management practices for Payment Facilitators. We reviewed compliance obligations, strategies for managing associated risks, and how to maintain a secure and efficient payment ecosystem.

Mastercard Payment Gateway Service (MPGS) Walkthrough: We received a hands-on walkthrough of the MasterCard Payment Gateway Service (MPGS). This session covered the gateway's features, functionalities, and integration processes, providing valuable insights into how to effectively utilize MPGS for seamless transaction processing.

Overall, the training offered a comprehensive view of Mastercard’s frameworks and tools for enhancing performance, managing risks, and optimizing payment processing. The knowledge gained will be instrumental in our work Gamswitch Company Ltd refining our practices and ensuring robust, secure, and efficient operations.